In an election year, it’s doubtful they would have the courage to do it.

Total stock market gain 2017 torrent#

Interest rate rises are off in the future and when the Fed tries to raise them, the government will be hit with a torrent of hate.

But some sort of deal will get struck and stimulus will power growth. Stimulus funding might be delayed until the spring. GDP should grow modestly in 2022 by 2.1%.

Total stock market gain 2017 full#

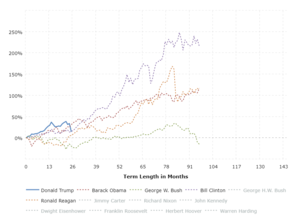

They’re pessimistic right now, but as spring approaches and Covid fades, the pace of spending, employment and production will increase.Īs the supply chain issues ease this winter and booster shots get administered, return to work will be in full swing. Holiday spending is hitting record highs and consumers have lots of cash. Some advisors are bullish on housing construction stocks. The housing market forecast is a little brighter too with strong price growth forecasts, and more construction is expected. Omicron is a threat, but it doesn’t appear to be the deadly variety everyone was reacting to. However, what drives optimism is the continuing recovery. This week brought both anxiety and discouragement to the markets. Stocks last 3 months courtesy of Yahoo Finance. The net result is they will begin to support economic growth while carrying out more tapering. Their policy of causing inflation and then raising rates to fight it will cost them next November. The current US government is facing elections in 2022 and they will do an about face on economic suppression. The gloom and doom pessimism is overstated. Looks like volatility will be with us for a while. Consider that the recovery hasn’t really started, there are supply chain issues, stimulus spending hasn’t started, and corporate earnings have lots of room for growth next year. Most believe big earnings are over and interest rates will rise. For this reason, the S&P Composite 1500 index, which includes the S&P 500, as well as the S&P MidCap 400 and the S&P SmallCap 600, is a better representation of the overall market.Īnother good option is the Russell 3000 index, which includes twice as many stocks, and combines the Russell 1000 index of larger companies with the well-known Russell 2000 index of small caps.As 2021 comes to a close, investors are looking ahead, gathering experts projections for 2022 prices. However, the S&P 500 has one major shortcoming: It doesn't reflect the performance of small or midsized companies. stock market capitalization is represented by the index.

Since the index includes large companies, 80% of the overall U.S. The technology sector makes up more than 40% of the Nasdaq, but makes up only about 20% of the overall market.įinally, the S&P 500 includes 500 stocks, and is a good representative mix of the industries that make up the overall market.

The Nasdaq Composite considers nearly 3,000 stocks listed on the Nasdaq, but it's important to realize that it is a very tech-heavy index.

The Dow Jones Industrial Average only considers 30 companies, and is a price-weighted index, which places more emphasis on stocks whose share prices are high, as opposed to weighting in favor of larger companies (as most other indexes do). Out of the three, the S&P 500 index is probably the best indicator of how the stock market is performing, but there are even better choices out there. Which is the best way to gauge how the overall U.S. Watch Video: 30 years on: Could there be another Black Monday? Q: The news headlines feature the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite indexes.

0 kommentar(er)

0 kommentar(er)